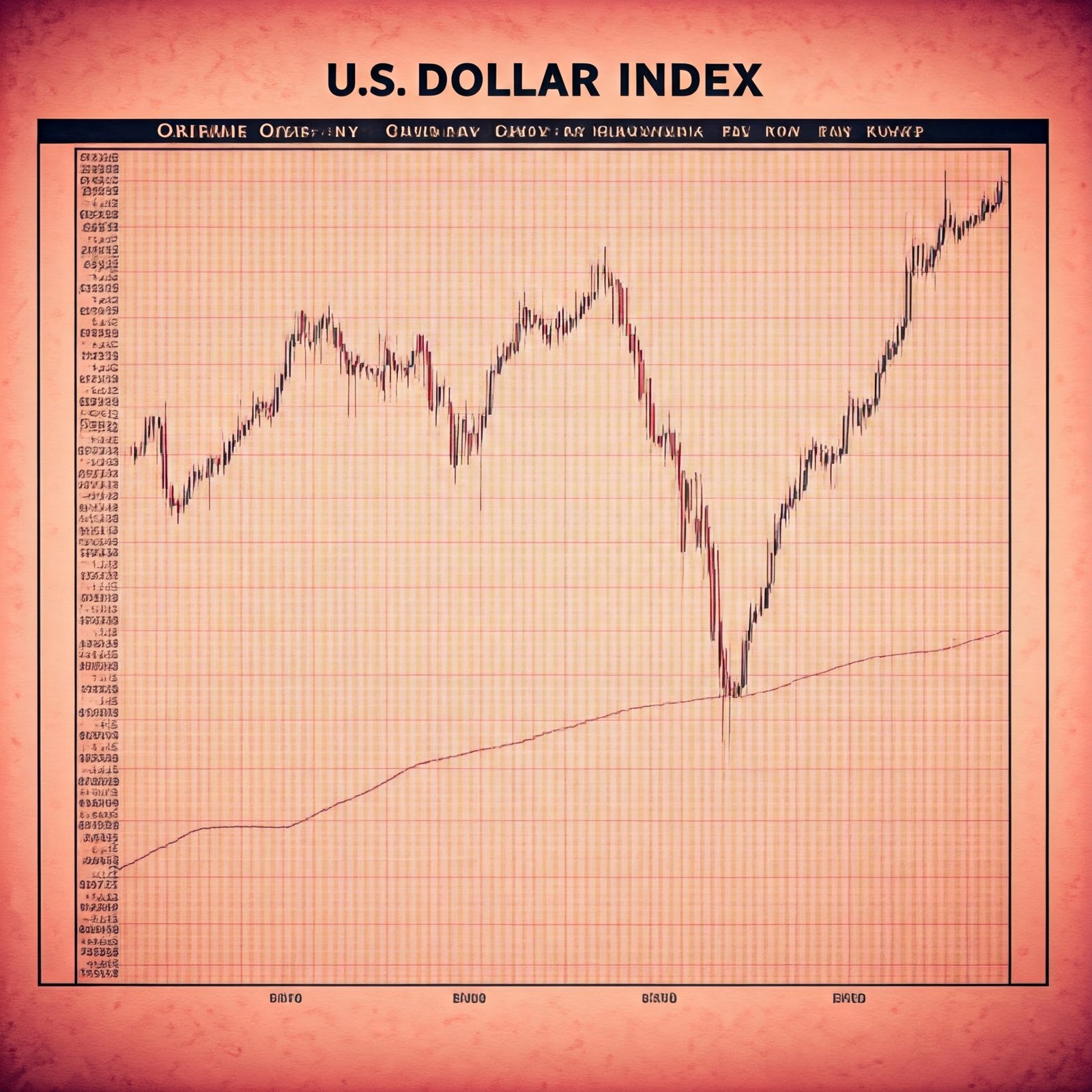

U.S. Dollar Surges to 2022 High, On Track for Strongest Year in 10 Years

The U.S. dollar index surged to its highest level since November 2022 on Tuesday, capping off a year of exceptional strength. The index, which measures the greenback’s performance against a basket of six major currencies, has been buoyed by a number of factors, including:

- Solid U.S. Economy: The American economy has continued to outperform its peers in 2024, with robust growth and a relatively low unemployment rate. This has attracted foreign investment to the U.S., boosting demand for the dollar.

- Federal Reserve Policy: The Federal Reserve’s decision to slow the pace of interest rate cuts has also supported the dollar. While central banks around the world are easing monetary policy, the Fed’s more cautious approach has helped to widen the interest rate differential between the U.S. and other countries. This has made dollar-denominated assets more attractive to yield-hungry investors.

- Global Uncertainty: Geopolitical tensions and a slowdown in global growth have also contributed to the dollar’s strength. In times of uncertainty, investors often flock to the dollar as a safe-haven asset.

The dollar’s rally has been particularly pronounced against some currencies, such as the Japanese yen and the New Zealand dollar. These currencies have been weakened by their respective central banks’ dovish monetary policies.

Looking ahead, the dollar’s outlook remains positive. The U.S. economy is expected to continue to outperform in 2025, and the Fed is likely to maintain its relatively hawkish stance on interest rates. This could lead to further gains for the dollar.

Please follow and like us:

Post Comment